Data Center Accelerator Market to Reach $97.8 Billion by 2032, Driven by AI and ML Adoption: DataM

According

to DataM Intelligence, the Data Centre Accelerator Market reached US$ 17.3 billion in 2024 and is

expected to reach US$ 97.8 billion by 2032, growing at a robust CAGR of 24.18%

during the forecast period 2025–2032. The growth is primarily driven by the

rising deployment of AI and deep learning applications, increasing data center

traffic, and the demand for energy-efficient computing solutions. Among product

types, GPUs dominate the market due to their high parallel processing

capabilities, making them ideal for AI training and inference workloads.

Geographically, North America is the leading market, supported by advanced

hyperscale data center infrastructure, high technology adoption, and

significant investments in next-generation computing systems.

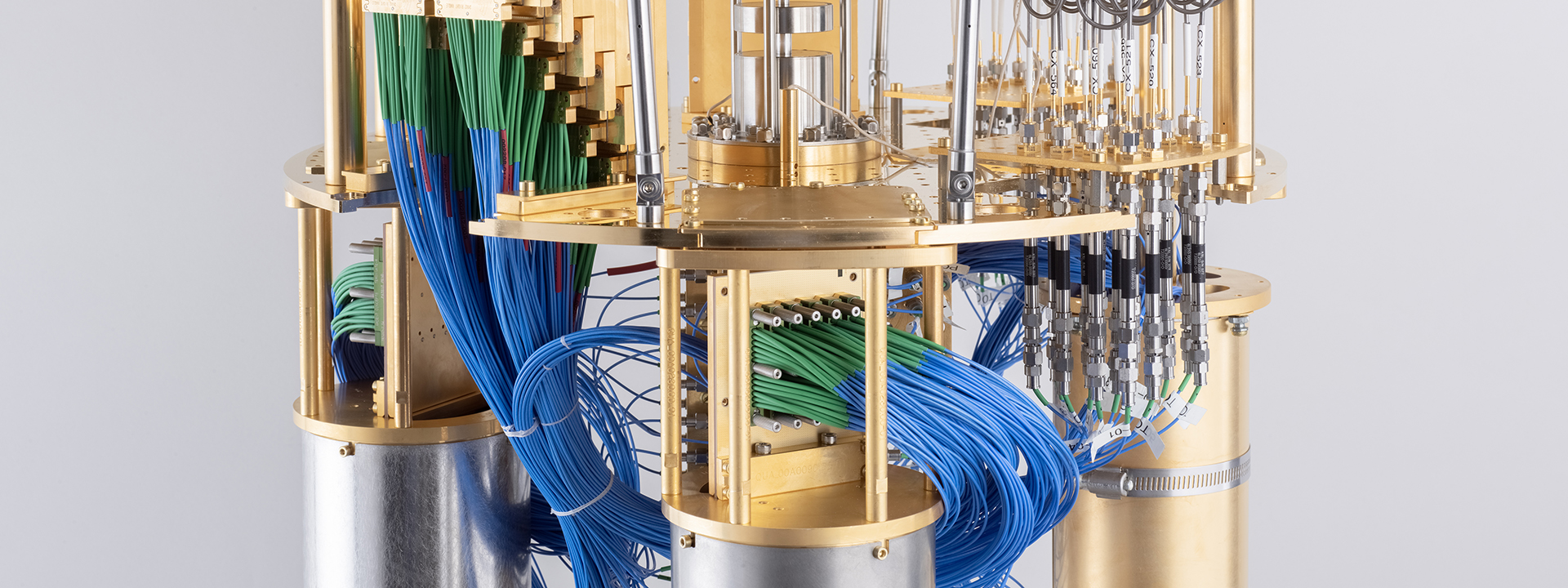

The Data Center Accelerator Market is witnessing

exponential growth, fueled by the increasing adoption of high-performance

computing, artificial intelligence (AI), and machine learning (ML) workloads.

Data center accelerators, including GPUs, FPGAs, and ASICs, significantly

enhance computing efficiency, reduce latency, and accelerate processing speeds

for complex data-intensive operations. With the surge in cloud computing, big

data analytics, and edge computing, accelerators have become critical

components in modern data centers, enabling enterprises to handle massive

computational demands while optimizing power and space utilization.

Market Segmentation:

The Data Center Accelerator Market is segmented by

product type, end-user, and deployment type.

Product Type: The

market includes GPUs (Graphics Processing Units), FPGAs (Field-Programmable

Gate Arrays), and ASICs (Application-Specific Integrated Circuits). GPUs

dominate due to their ability to perform large-scale parallel processing, ideal

for AI, ML, and deep learning workloads. FPGAs provide flexibility and

reconfigurability for specialized tasks, while ASICs are tailored for specific

applications like AI inference and cryptocurrency mining.

End-User: Key

consumers include hyperscale data centers, enterprise data centers, cloud

service providers, and government organizations. Hyperscale data centers lead

adoption due to their substantial AI workloads and high-performance computing

requirements, while enterprises leverage accelerators to improve application

performance, reduce operational costs, and enhance computational efficiency.

Deployment Type: Accelerators are deployed in on-premises data centers and cloud-based infrastructures.

Cloud deployments are rapidly growing due to scalability, flexibility, and cost

advantages. Organizations increasingly rely on cloud accelerators to

efficiently manage resources and meet growing computational demands.

Regional Insights:

The regional dynamics of the data centre

accelerator market highlight North America as the largest market, followed by

Europe, Asia Pacific, and the Rest of the World (RoW).

North America: The U.S. is a key driver in North

America due to major hyperscale cloud operators like AWS, Microsoft Azure, and

Google Cloud. Investments in AI research and next-generation computing

infrastructure support robust accelerator adoption.

Europe: Countries like Germany, the U.K., and

France are investing heavily in high-performance computing facilities and

AI-driven initiatives, contributing to market growth.

Asia Pacific: Rapid cloud infrastructure

expansion, rising AI and IoT adoption, and government support for digital

transformation projects are driving growth in China, Japan, and India.

Rest of the World (RoW): Emerging markets in the

Middle East, Africa, and Latin America are witnessing increased demand due to

growing internet penetration, digitalization, and adoption of cloud computing.

Market Drivers

The data center accelerator market is propelled by

the increasing adoption of AI and ML workloads, growing demand for

high-performance computing, and rising data traffic in cloud and hyperscale

data centres. Accelerators provide superior computational performance while

optimizing energy consumption, making them a preferred choice for both

enterprises and cloud service providers. Additionally, the expansion of edge

computing and data-intensive applications, such as autonomous vehicles, video

analytics, and genomics, is further boosting adoption.

Market Restraints

High capital expenditure and operational costs can

limit adoption, particularly among small and medium-sized enterprises.

Integration challenges with existing IT infrastructure and the need for skilled

personnel to manage accelerators may also hinder growth. Rapid technological

advancements can lead to obsolescence, adding uncertainty to long-term

investments.

Market Opportunities

Opportunities lie in energy-efficient

accelerators, AI-driven cloud services, and specialized workload solutions.

Vendors developing low-power, high-performance accelerators can attract

sustainability-focused organizations and hyperscale data centers. Furthermore,

growing AI adoption in emerging markets presents opportunities for new

deployments. Strategic collaborations between hardware vendors and cloud

providers are likely to accelerate market penetration and innovation.

Leave A Comment